Nice Info About Snowball Budget Sheet

Repeat until each debt is paid in full.

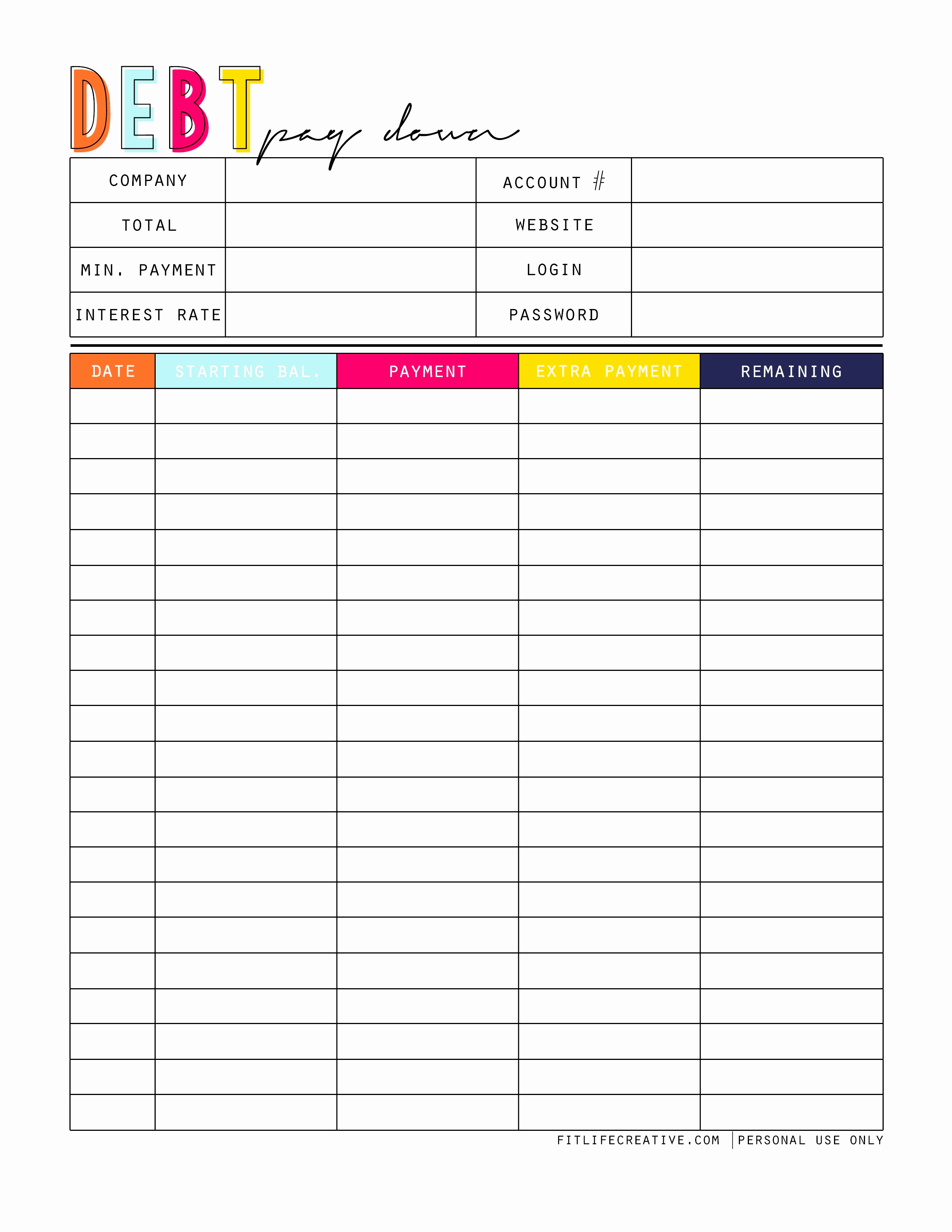

Snowball budget sheet. Enter all your debts into the debt snowball calculator (excel) once you have the file open, click on the data tab and update all example debts with your debts. Download the sheet here so you can use it to make calculations and check your progress. It boasts plenty of tools to calculate monthly and yearly expenses instantly.

Tagged debt payoff debt snowball f6f5f0 google sheets templates microsoft excel template by brynne conroy on january 29, 2024 managing debt is a normal part of the modern financial. In this article, we’ll detail what a debt snowball method is, how it works, and how to create a debt snowball spreadsheet in google sheets. Researchers say the snowball method is the best way to pay off debt — here's a simple spreadsheet that can make it work for you written by emmie martin feb 17, 2017, 1:58 pm pst employing the.

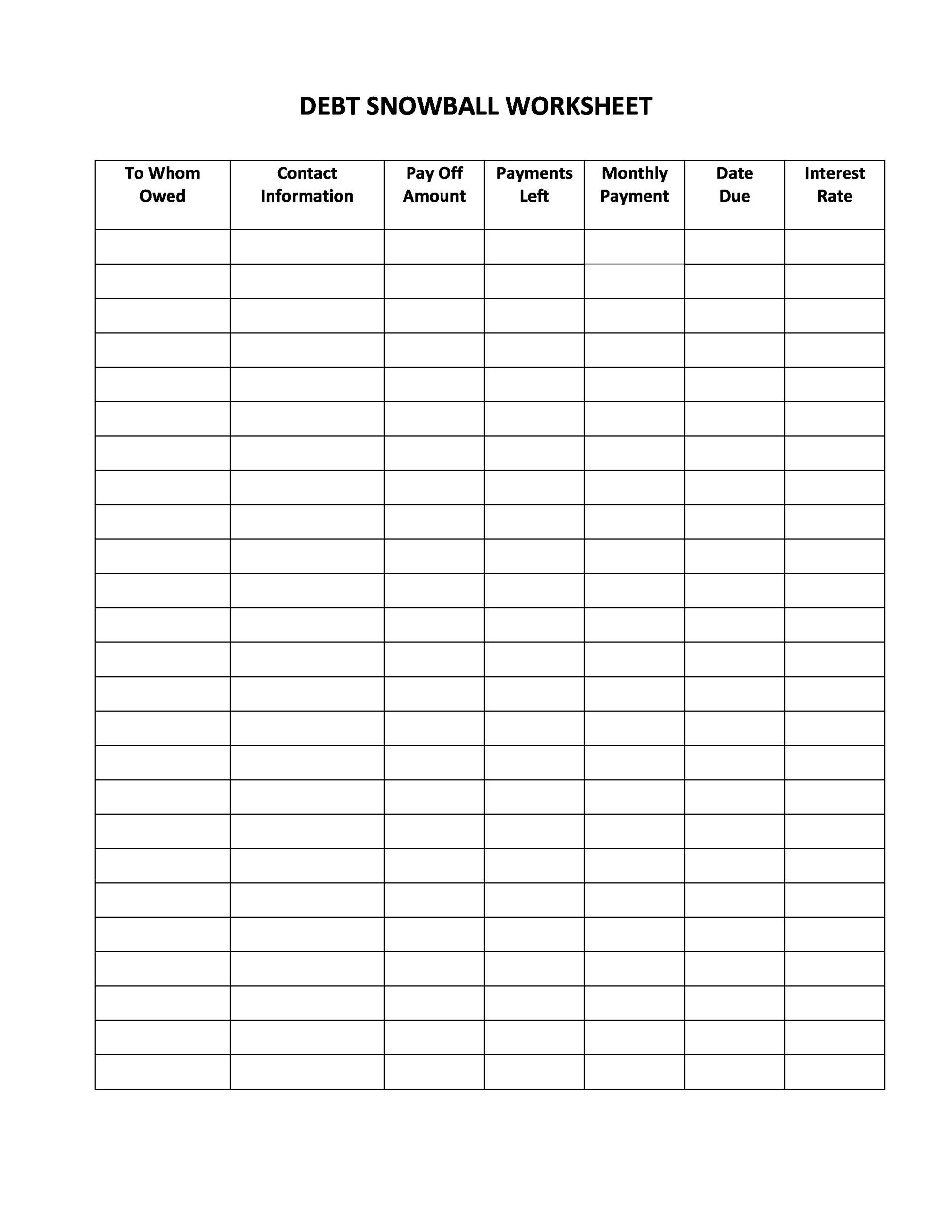

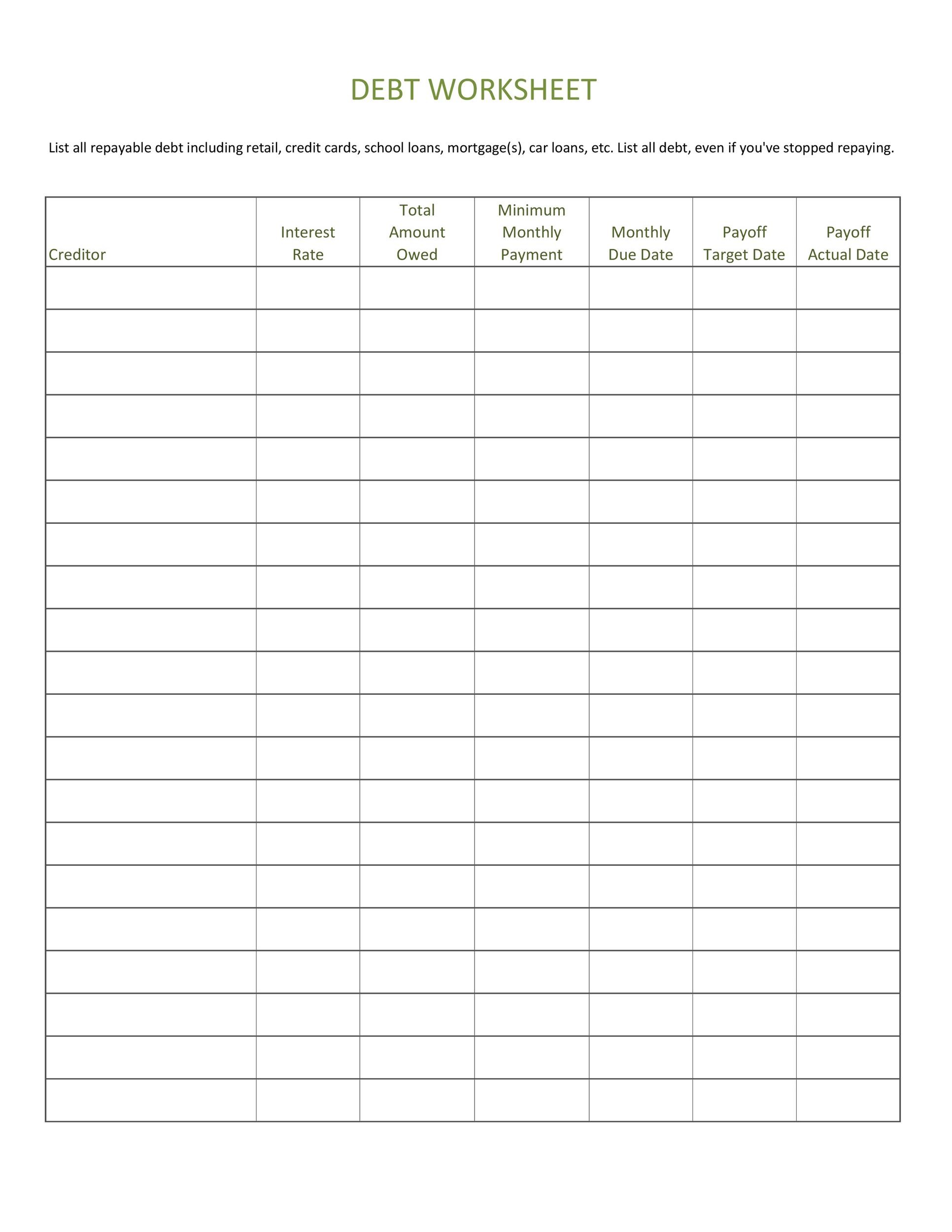

In the first worksheet, you enter your creditor information and your total monthly payment. List your debts from smallest to largest (regardless of interest rate). Throw as much extra money as you can on your smallest debt until it’s gone.

You’ll need a template to keep track of all your debts. You can download a free debt snowball spreadsheet and use the debt snowball method to pay off your debt. You just need a plan.

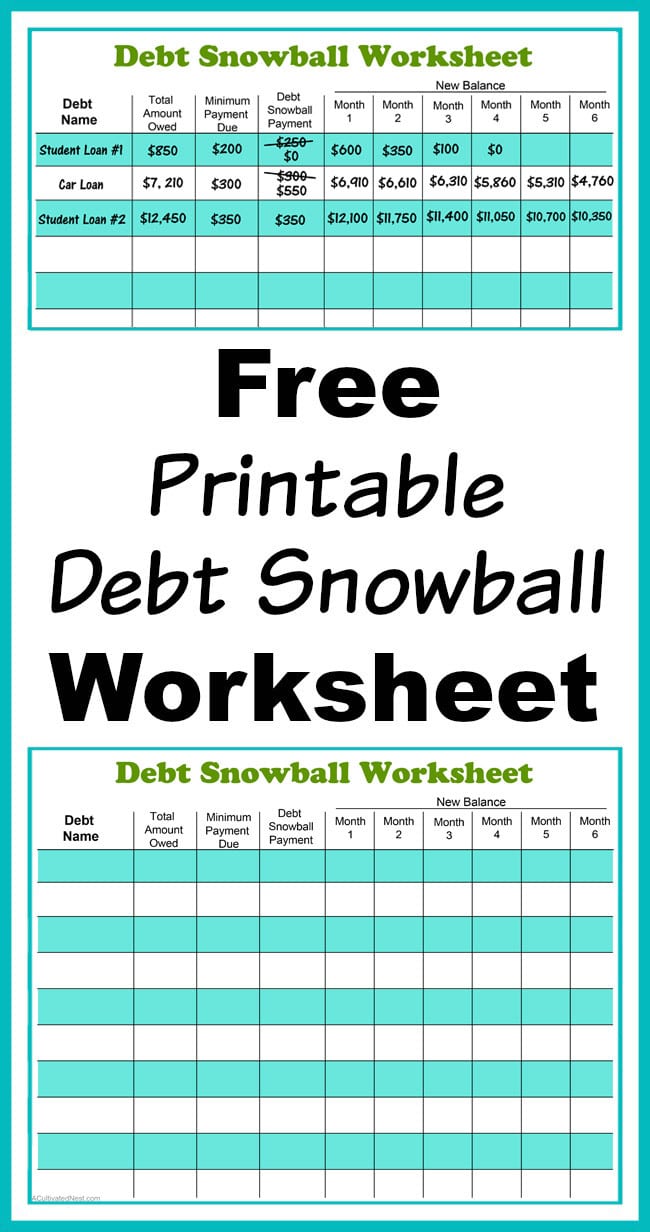

Use this form to break down each paycheck and tell your money where to go. You will cross off each month as that bill is. Month 1 of your debt snowball.

We have lots of budget printables available in our shop and for free to help you on your debt free journey. To make it easier for you to start your debt snowball, i created a free printable debt snowball worksheet! List your debts from smallest to largest regardless of interest rate.

In month one, you would pay the minimum payments to debts 2, 3, and 4. Make minimum payments on all your debts except the smallest debt. Learn how to make a debt snowball spreadsheet in excel or google sheets.

This field takes your total debt and divides it by your monthly snowball. Get it for free here. Easily create a debt reduction schedule based on the popular debt snowball strategy, or experiment with your own custom strategy.

For beginners, we will also provide you with a simple, free debt tracker spreadsheet template to use. $1,000 ($50 minimum payment) + $740. Debt snowball spreadsheet from spreadsheet point for google sheets platform:

However, there’s no need to panic: Download lump sum payment form Tracking your debts is also made easy by this spreadsheet program.