Supreme Info About Income Tax Calculator On Salary In Excel Sheet

Based on the calculations, you can choose which tax regime you.

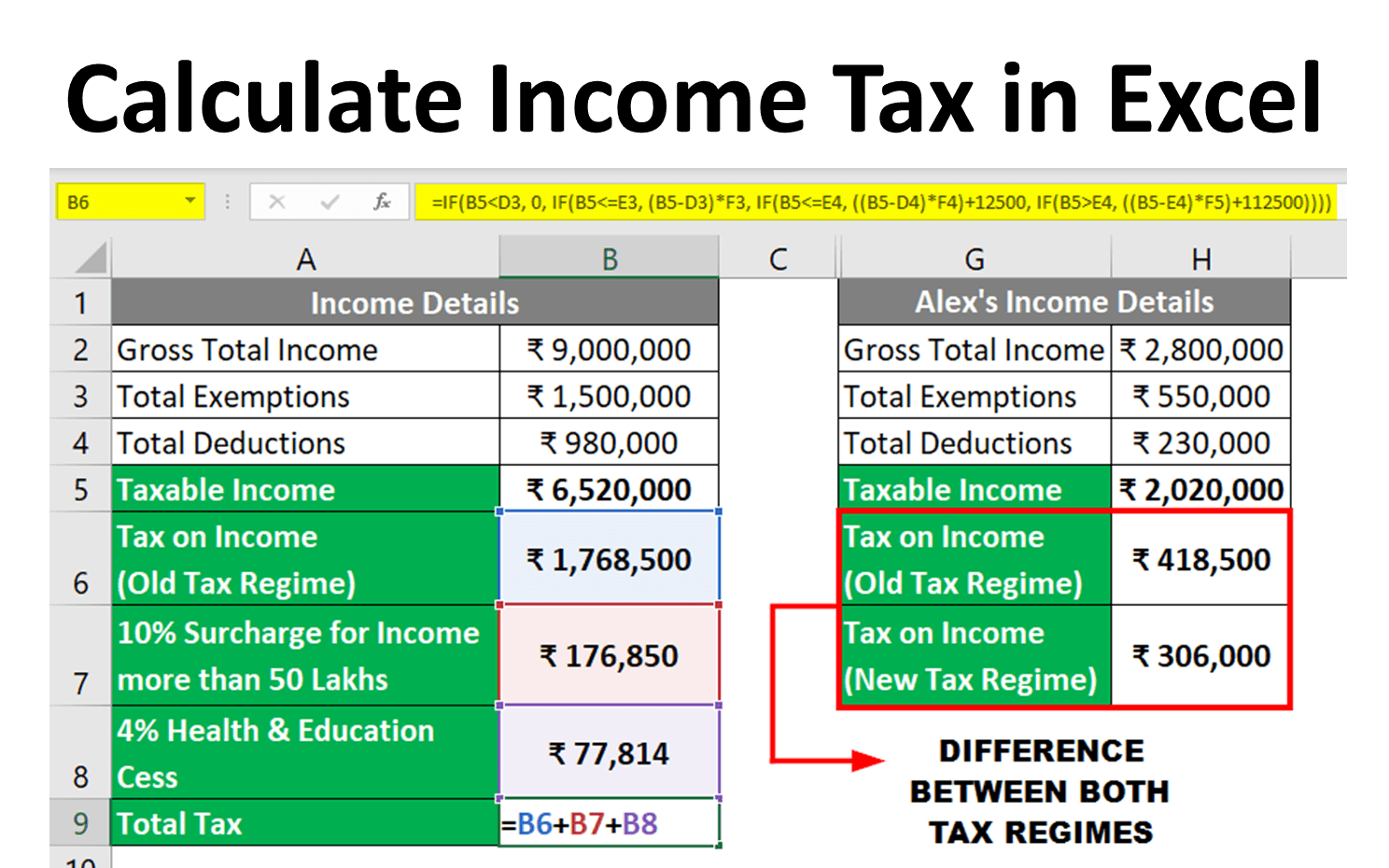

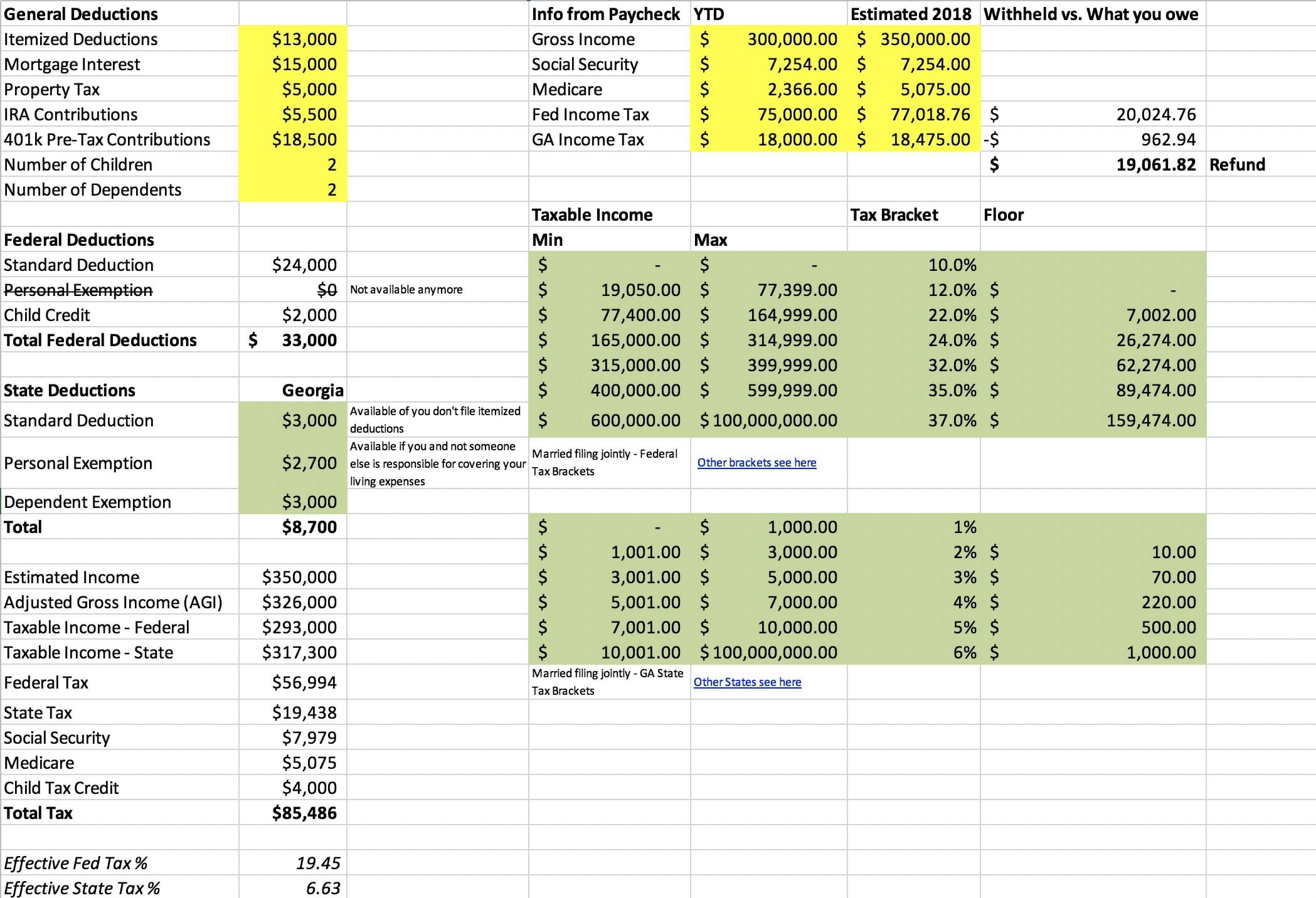

Income tax calculator on salary in excel sheet. Using excel functions to calculate income tax explore the various excel functions that can be utilized to calculate income tax based on taxable income, tax brackets, and rates. In excel available to download and edit 3. After adding above taxes = rs.

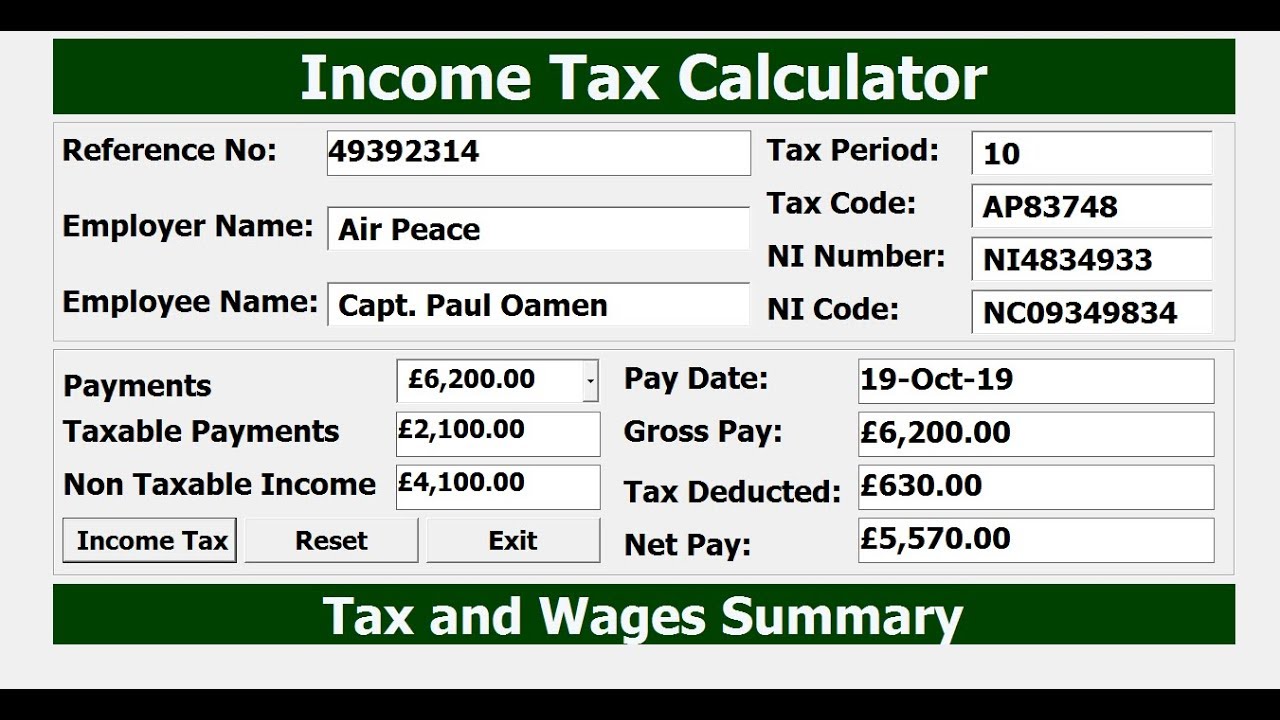

Uk personal tax calculator 2. Tax planning in the beginning of the financial year is always bet If the taxable income was $50,000, we would.

Make your own federal income tax spreadsheet. We can make a salary sheet by calculating and adjusting these amounts with basic salary through excel very easily. You total income tax = rs.

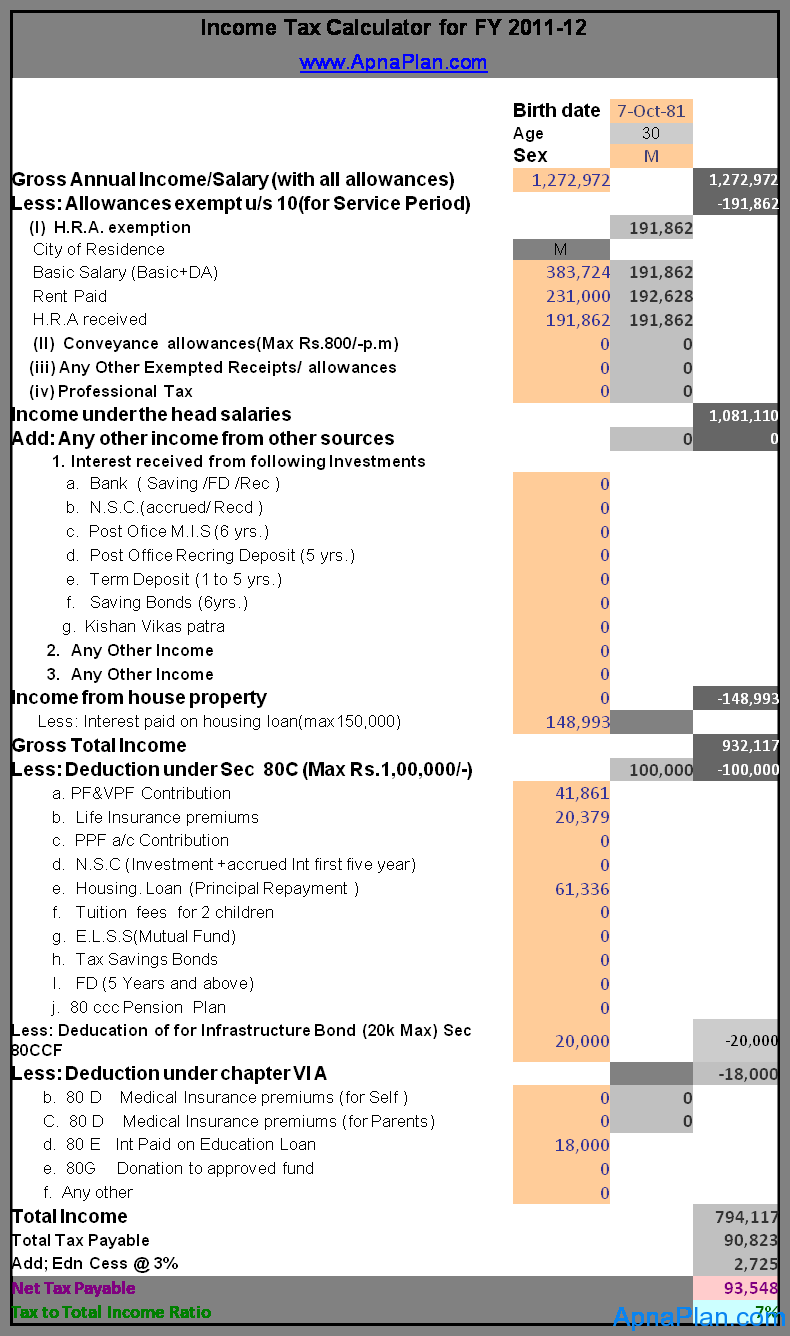

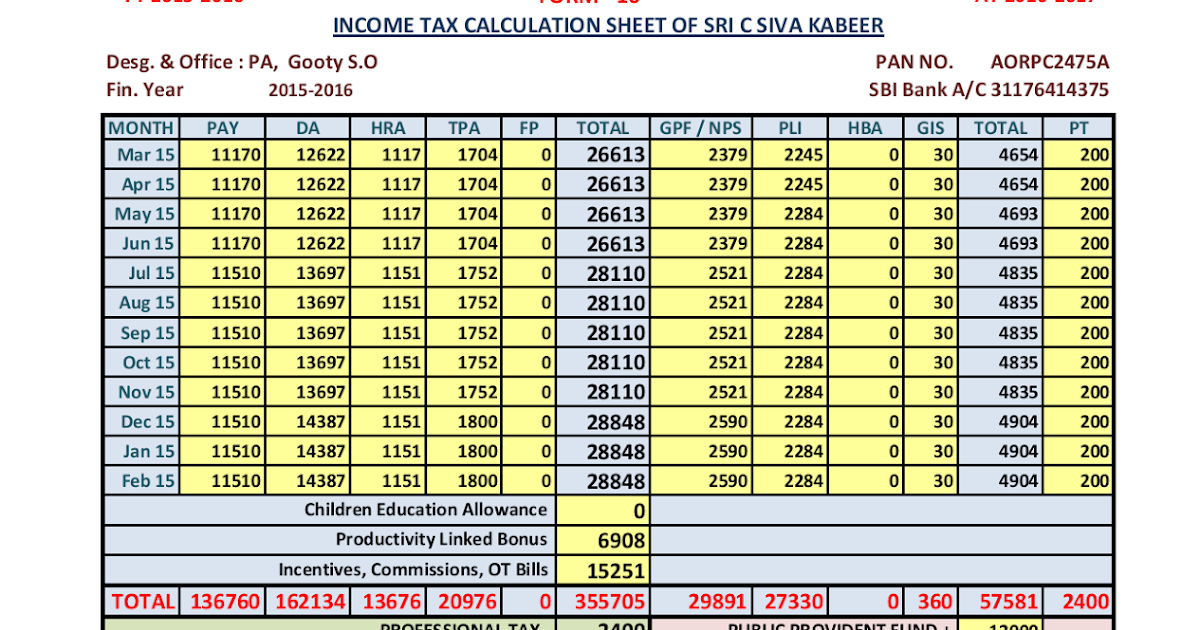

Suitable for salaried employees and business. Salary particulars can be given on monthly basis. How to calculate income tax on salary.

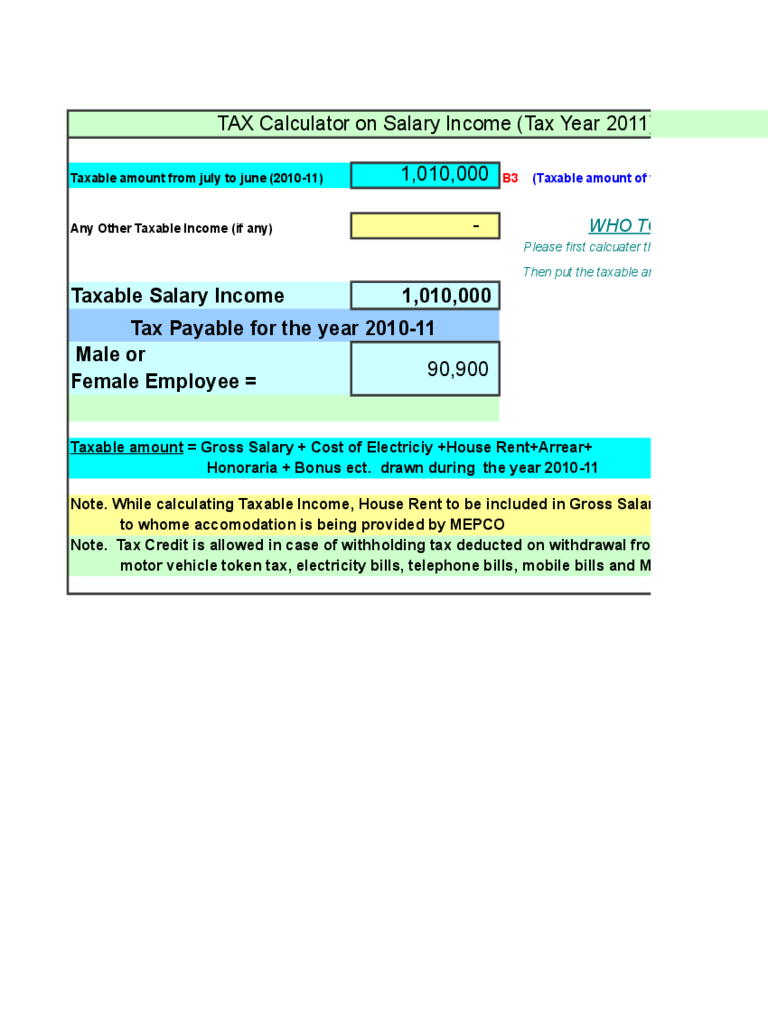

This income tax calculator helps you to understand your income tax based on old and new tax regime. You can use an excel income tax calculator by following these steps: Checking for errors in the calculations.

Organizing income and expenses data begin by creating a new excel. Click on the download link. Set up income tax slab we need to prepare the income tax slab first.

Here are the key steps to take when setting up your excel spreadsheet for income tax calculations: Tax calculation on multiple sources of income telling you what tax you pay on just. Perform annual income tax & monthly salary calculations based on multiple tax brackets and a number of other income tax & salary calculation variables.

95,000, 4% cess is applicable which is rs. Provide investments including standard deduction,. Calculate taxable income, tax, surcharge and cess.

There are various tax rates that exist depending on the country and region. Open the downloaded excel sheet and input your income value in “column b”. You always have the option of creating a personal federal income tax calculator spreadsheet.

Separate sheet for each source of income. The first cell should be $25,000 times 10%, the last. For our discussion, let’s consider the updated calculator in the screenshot below, which contains no helper column.