Real Info About Limited Company Expenses Spreadsheet

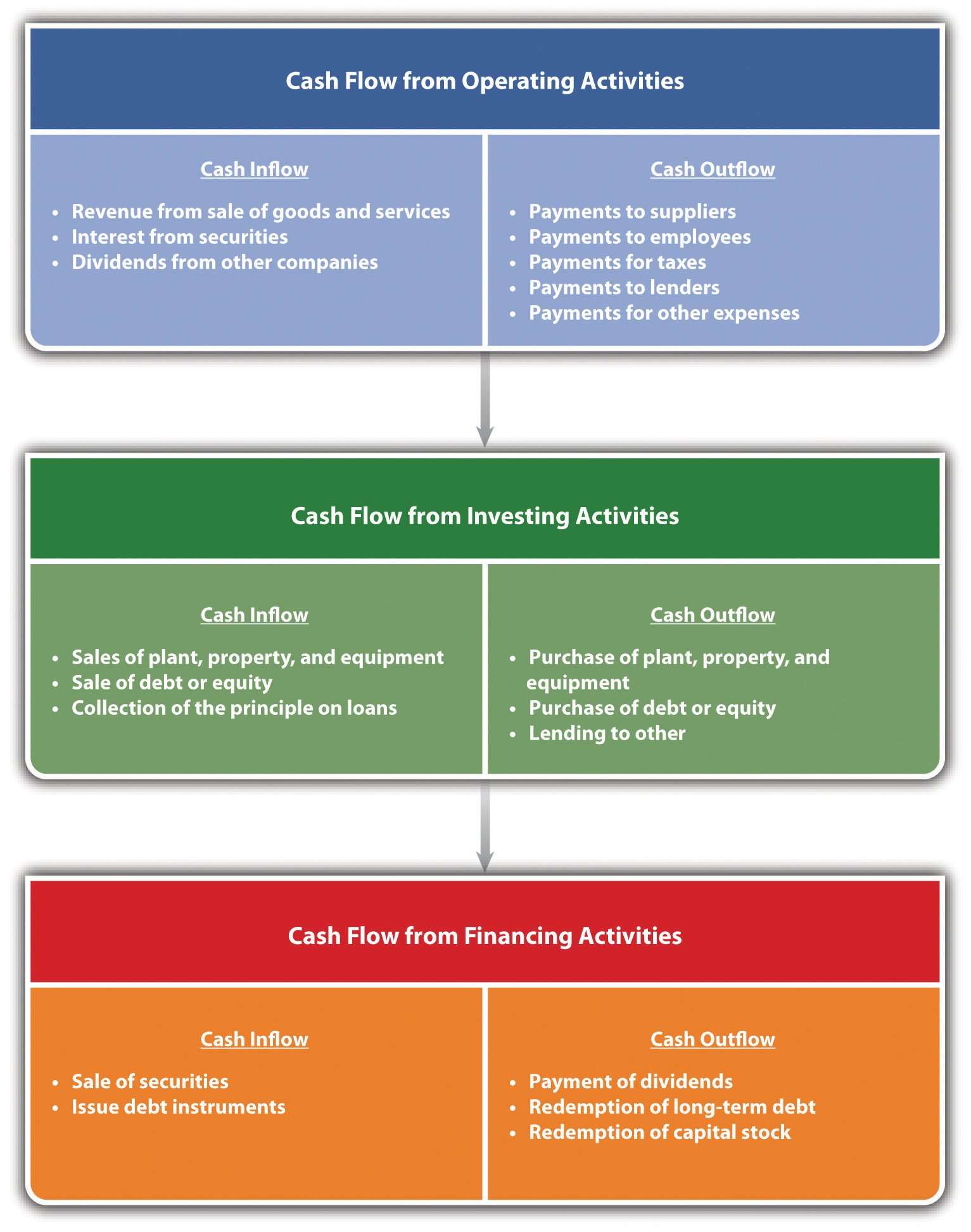

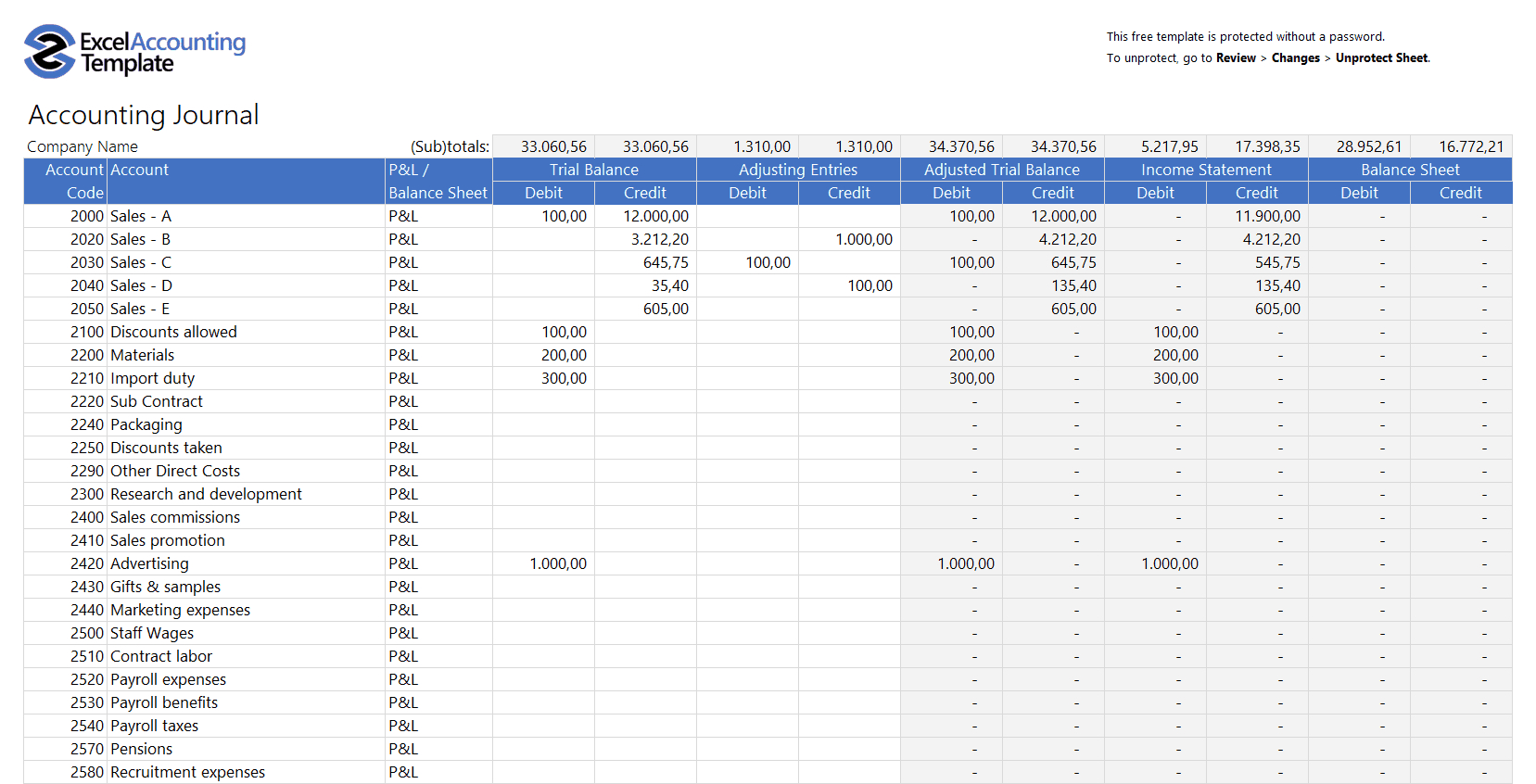

A balance sheet is one of the financial statements and is a legal requirement for submitting your accounts if you run a limited company.

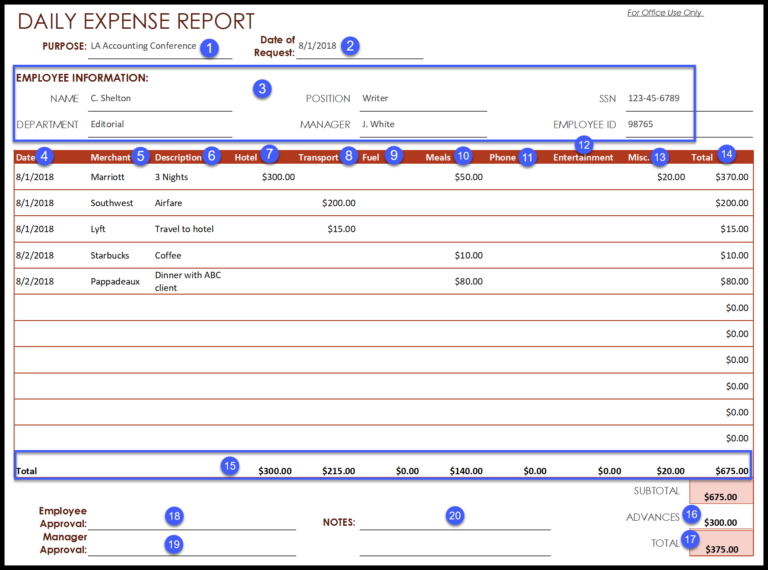

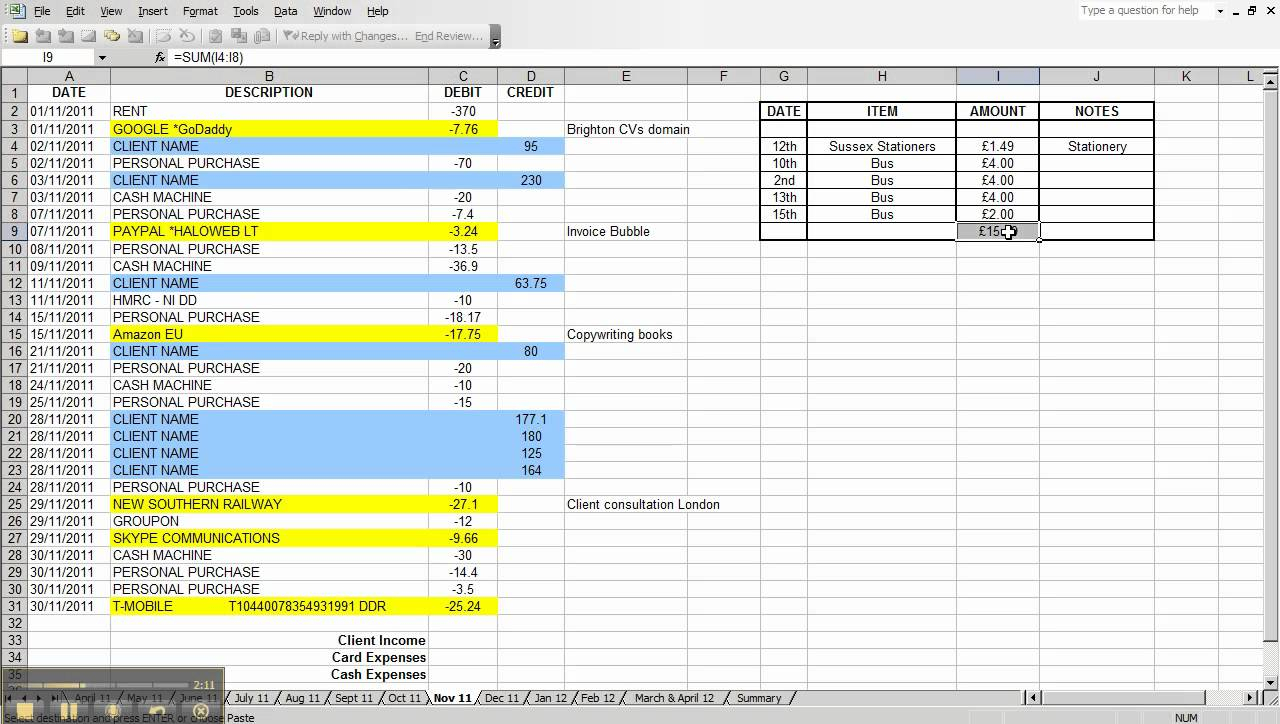

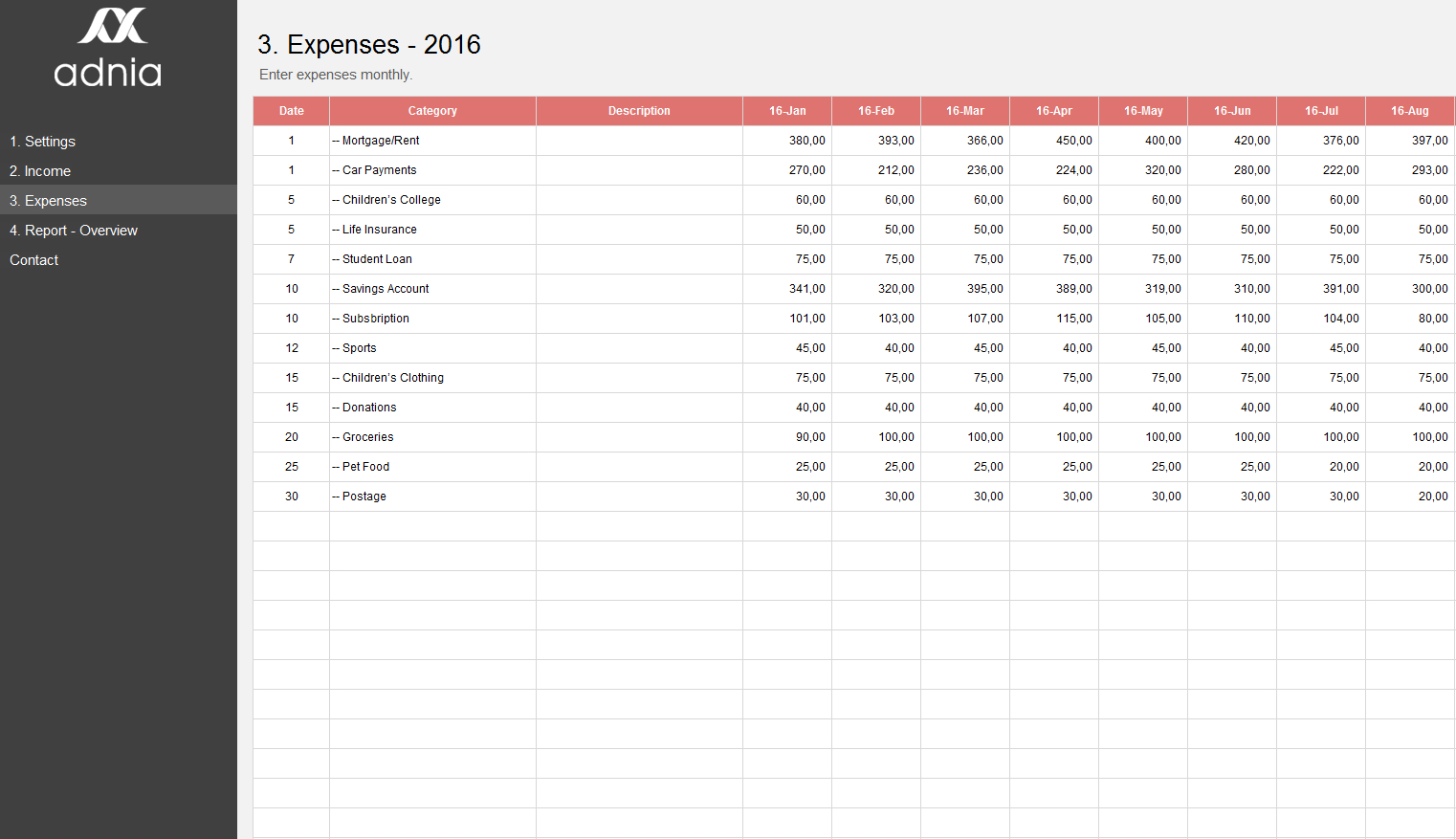

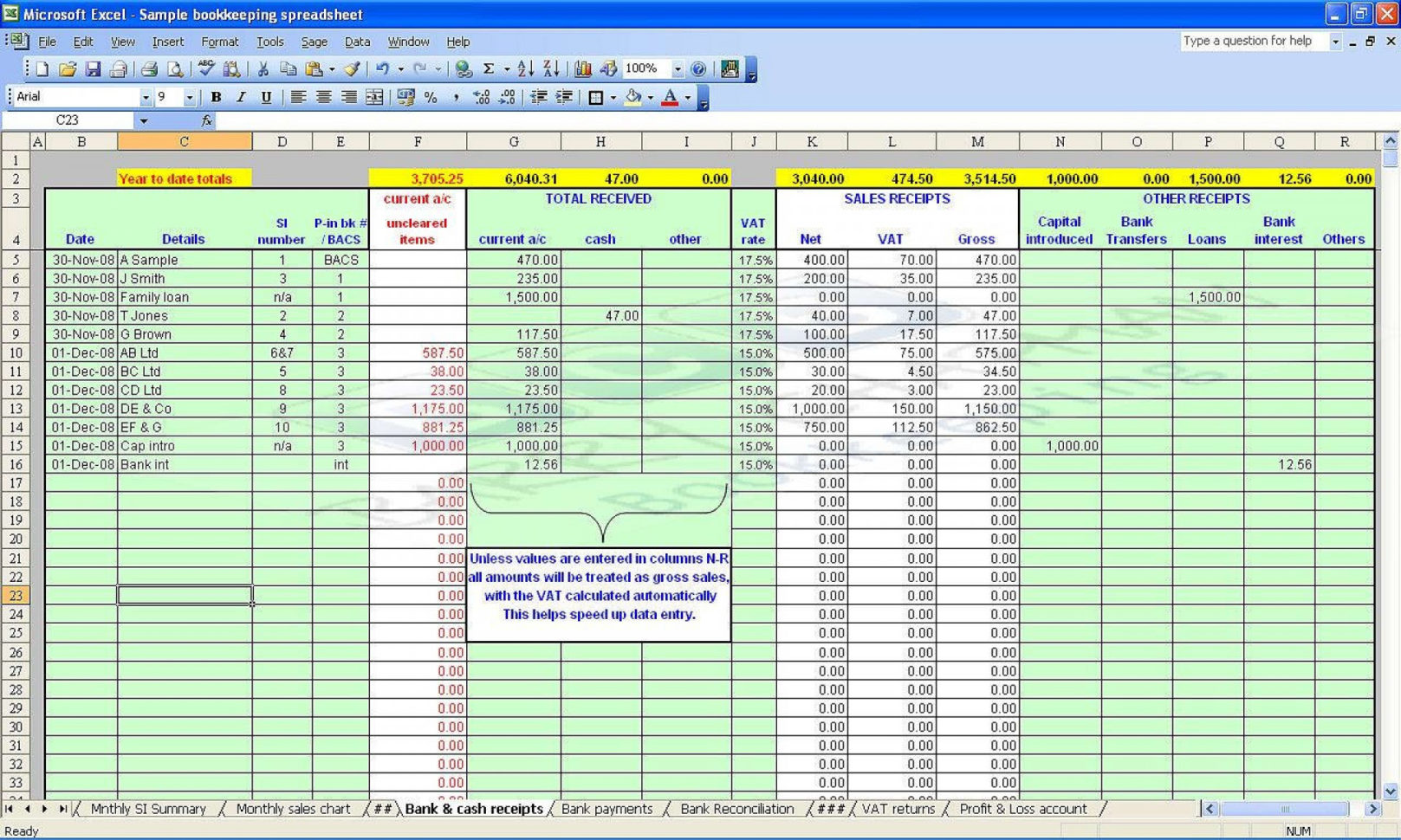

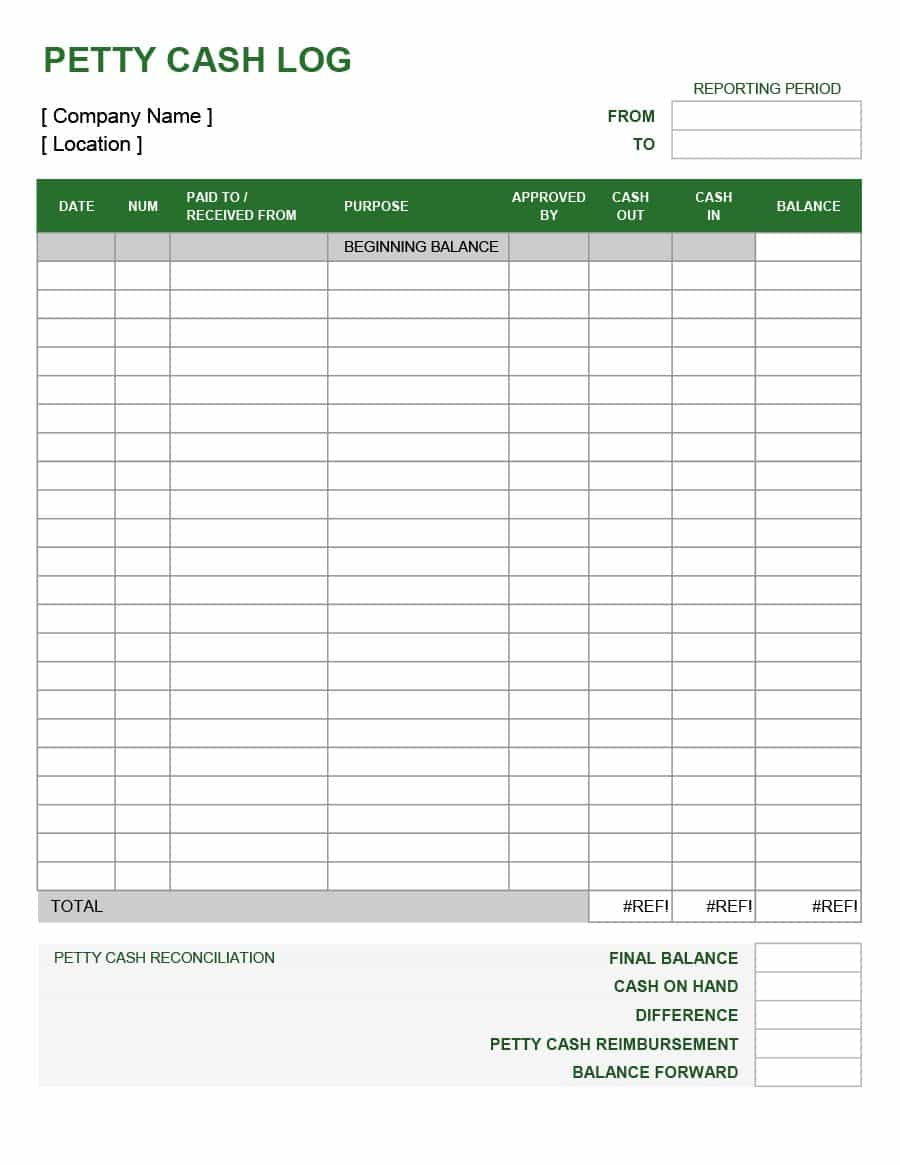

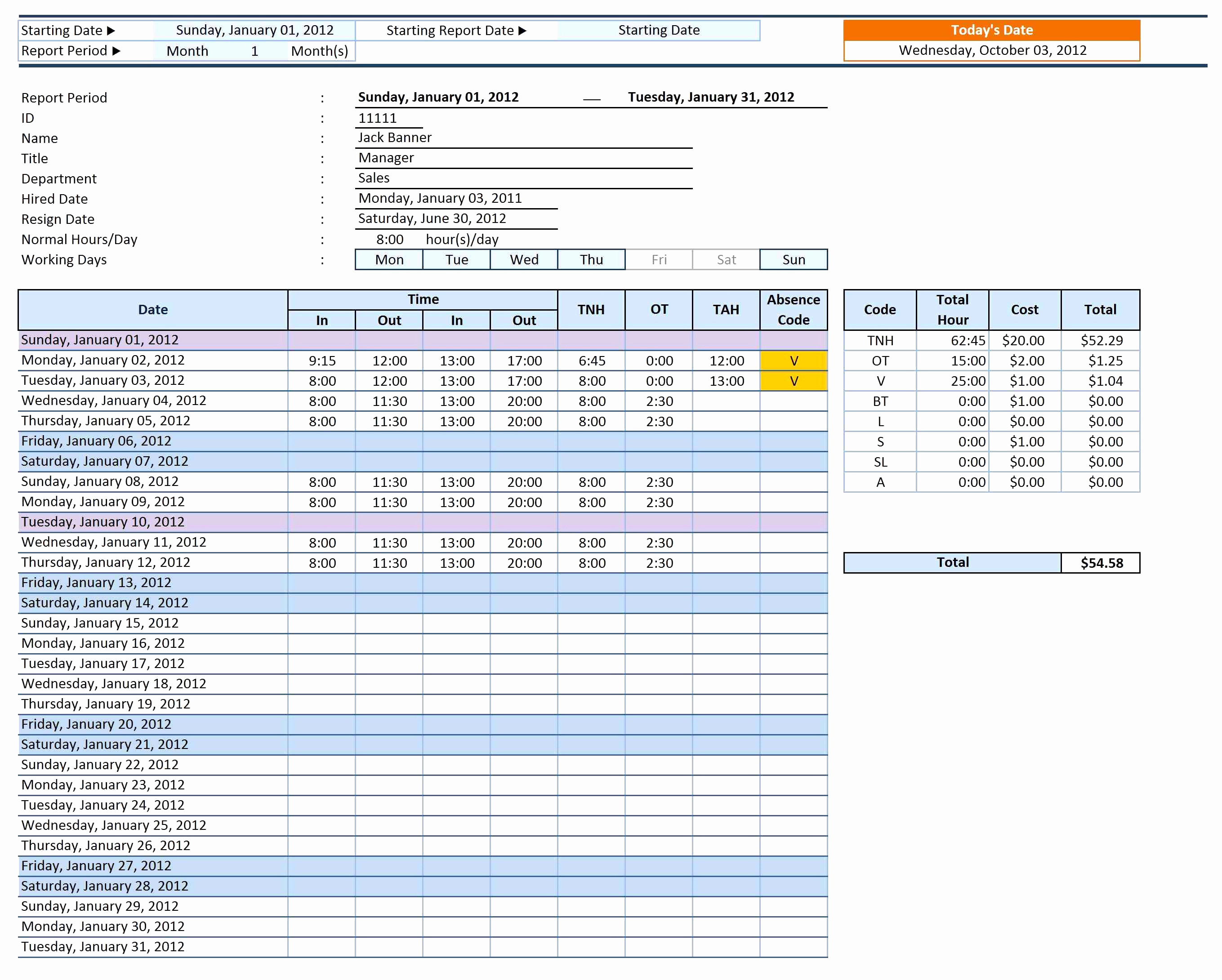

Limited company expenses spreadsheet. Crunch free will help get you organised as you start to grow your limited company, or your new sole trader business. It shows the assets, liabilities and equity at any given time. Track employee expenses & mileage with this excel claim template here at.

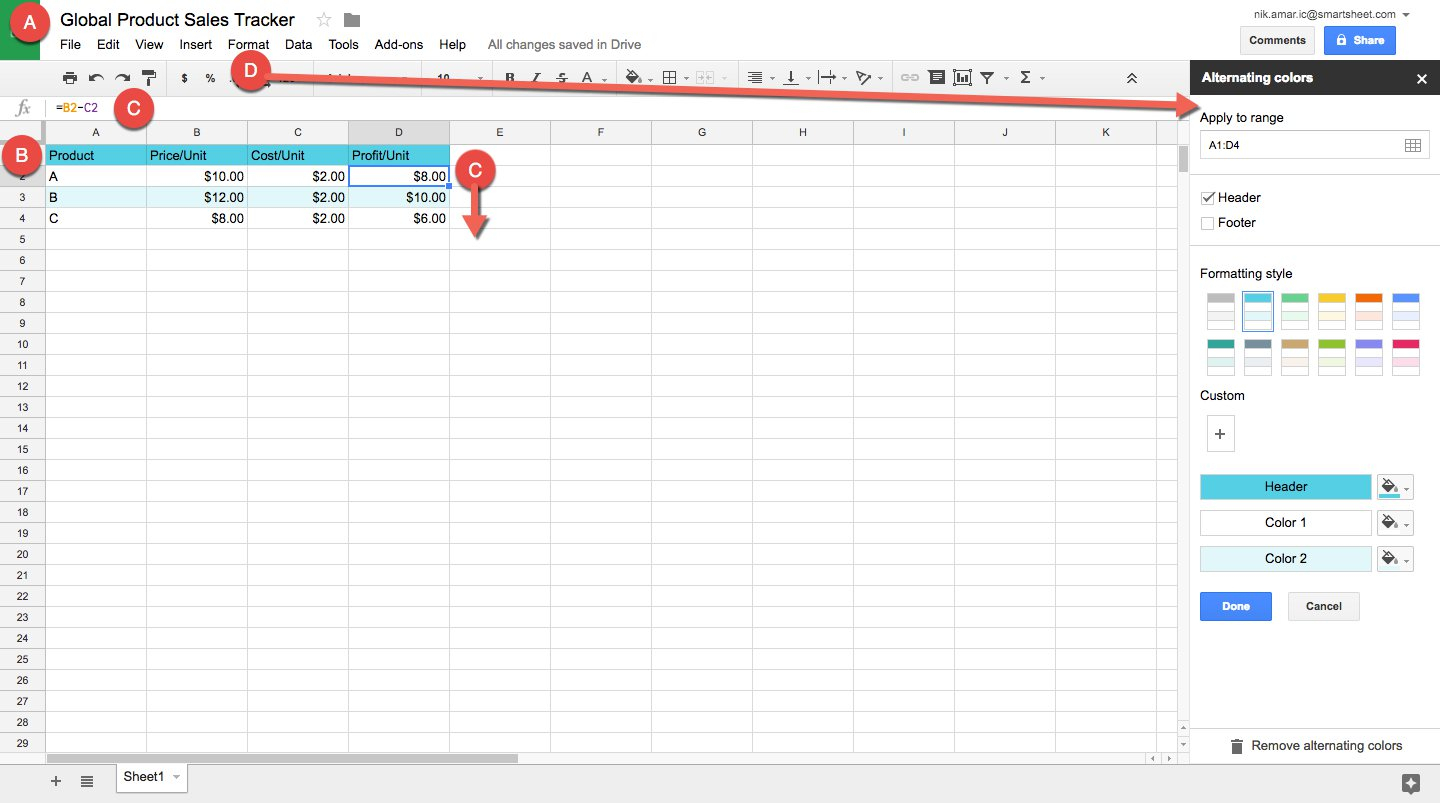

Use the existing category names or. A simple and free downloadable excel template for tracking employee expenses and mileage. Limited company expenses are allowable expenses that your business can claim, helping you reduce your corporation tax bill.

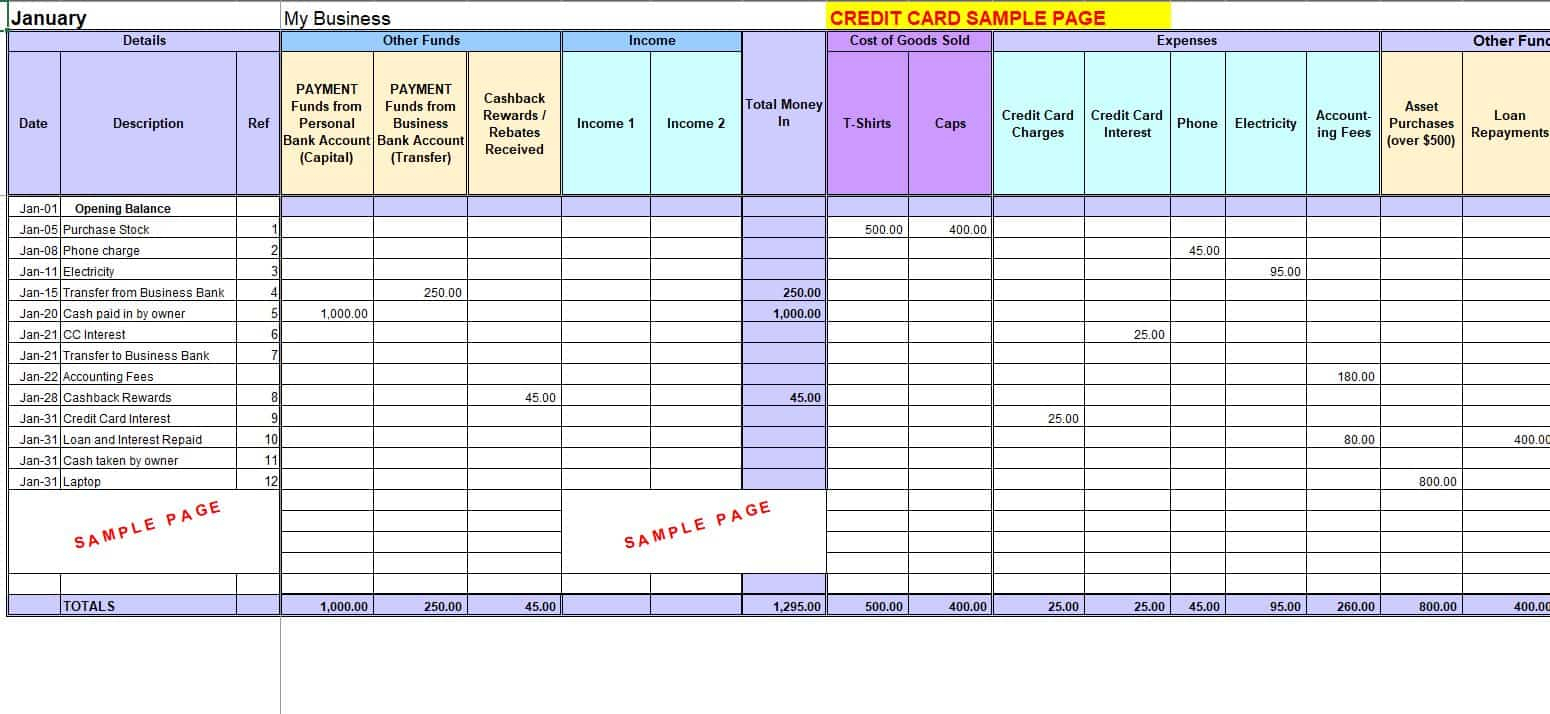

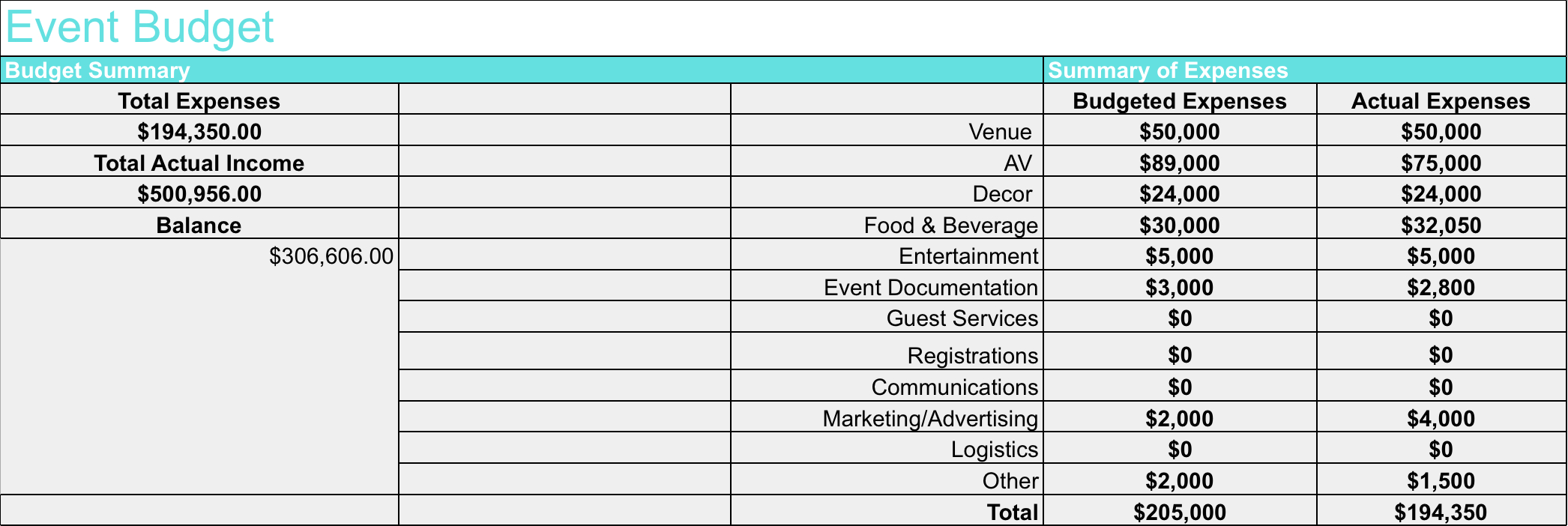

Startup expenses template if your business is just getting off the ground, this startup expenses template can help guide you on what you need to keep track of. If you’re running a limited company, you can deduct any business costs from your profits before tax, and you’ll need to report any item you make personal use of. A business expenses spreadsheet is a digital document that allows you to record, categorize, and analyze your company’s expenses in a structured and efficient.

Here, we look at the allowable expenses your limited company can claim for tax purposes, how you can claim and what you should keep an eye on to ensure you. Our free software lets you easily send. To recap, allowable business expenses are defined by hmrc as those that are “wholly necessary.

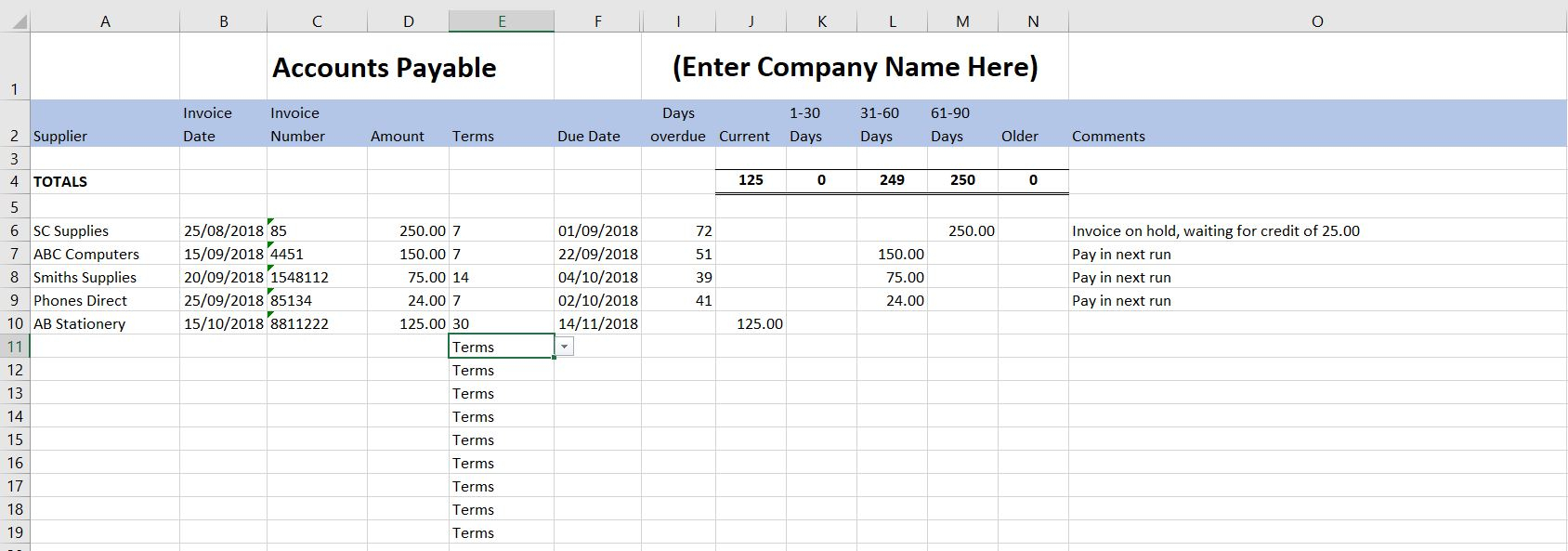

A simple microsoft excel spreadsheet to help you prepare a balance sheet. 10 expenses your limited company can claim 1. If you have a limited liability company (llc) and is required to file form 1065, business expense spreadsheet could be used to track all your business expens.

Our balance sheet template helps look at. Office and equipment expenses 4.